Inflation, Ugh... What Is This, 2022?

At the risk of slight hyperbole, the last couple of weeks have scored mighty high on the market’s Monumental-O-Meter. This is because three months of higher-than-hoped-for inflation can no longer be easily dismissed as "an anomaly on the way down." These persistent trends are now compelling people to rethink even the best-laid plans, starting with our Fed Chairman, Jerome Powell.

“The recent data have clearly not given us greater confidence and instead indicate that is likely to take longer than expected to achieve that confidence,” Jerome Powell on April 16, 2024

I know, I know, this whole inflation thing is so 2022… But some of the best advice I’ve received in life is to live in the “is,” i.e., accept the world as it is, not as we wish it were.

But first, a couple of housekeeping updates before we dive into our topic du jour (or du years, sadly): inflation, interest rates, and how everything in markets ultimately ties back to those two.

Recent Interviews

I have recently appeared on a few podcasts. Those all took place in relatively quick succession, so there is some natural overlap in topics, but they each have their areas of focus and personalities, so to speak. Click the links for access to episodes on Apple Podcast, Spotify, YouTube, etc.

Forward Guidance with Jack Farley. We talked about the theory of bubbles and the great bubbles in history (for which I owe a huge debt to my UCLA mentor Earl A. Thompson), credit bubbles, and how to think about the evolution of private credit as an investment strategy, among many things (Podcast Here).

Money Life with Chuck Jaffe. We talked about the Fed, where it stands on inflation, the longer tail to “T-bill and Chill,” and why you may want to escape life as a client of the Wealth Management Industrial Complex (Podcast Here).

Thoughtful Money with Adam Taggart. We talked about the risks facing Nvidia shareholders, what the current moment looks like vs. events like the 1980s Japan bubble, and some of my concerns around “engineered yield” products, like equity covered-call strategies (Podcast Here).

And if you prefer the written word, I was in The Wall Street Journal recently on portfolio “spring-cleaning” ideas.

Now, if you still want more (!), please connect with me on LinkedIn, which is where I post thoughts between newsletters.

And Now, Inflation… 2024 Edition

To keep the plot simple, inflation came in hot in January and people didn’t like it (See market moves on Feb 13, CPI inflation release day, for a gut feel). Then oops, it did it again in February. And then March came in hot, again. It was a case of fool me once, fool me twice, but up 0.4% three months in a row… Really?!?

But first, let’s roll back the clock for context. We had a massive inflation spike starting in 2021, on top of decades of low-ish inflation. Note that low-ish still hurts over time, as the graph below from Bloomberg highlights.

But what really caught people’s attention is what’s happened since the Covid “before-times.” This Wall Street Journal article is basically everything you need to know on why we’re all shocked at the inflation that’s taken place recently. It’s quickly shaken our faith in what a hundred bucks will get you out there. The answer is “roughly 35% less in groceries.”

But it’s not just food that’s a daily reminder of the nice things we used to have. It’s all sort of things, from Motor Vehicle Repair (+3.1% in March, highest since August 2022) to Funeral Expenses (+1.5%, highest since October 2022). By the way, car insurance is up a lot too, and yes, some of it is that cars are more expensive to repair and replace after an accident, but also that the smartphone era is causing more crashes and deadlier crashes, for good measure (Please think about that next time you’re texting at 65 MPH. Your “brain on texting” can quickly look like a sad omelet too).

And then there is housing… The whole idea behind the Fed hiking rates like it did was that it would cool housing, which would in turn cool the whole economic operation. Unfortunately, it hasn’t happened, and now homeownership costs are rising at such a clip that it only makes sense that they are getting passed through in rents, creating an unholy loop of rising rents and rising property values. I guess, that’s what they meant when they said that houses are “real assets.” In the meantime, housing affordability hasn’t been this bad since 2006. Eech.

Anyway, you get the point, it looks like we’re not done with inflation, and inflation is not done with us. Now, there is the very real possibility that at some point maybe soon, higher prices (like if crude oil spikes well above $100 a barrel) could cause what economists cutely call “demand destruction” (read, a massive slowdown in production and consumption) but it’s sensible to argue that inflation will not come down from here until the economy really slows (which could happen because small businesses are struggling in the US or because China is already slowing down).

As a (very important) aside, if you think forward, we are well-advised to contemplate the possibility that inflation could be a nagging problem for the rest of the 2020s and beyond, on defense costs rising in this new Cold War of ours (estimated at $10T here - military spending is needed but wars — cold or hot — are expensive and inflationary propositions) and the exponential energy use from Artificial Intelligence (Here, here, and here). Maybe Taylor Swift is right to be buying carbon offsets (and keeping them for a rainy day). But we digress…

The Implications of “If, Not When” on Rate Cuts

I’ve never been a fan of the line that the Fed will only cut after they’ve broken something. It’s too much of a cheap shot at people trying really hard not to break anything. But we find ourselves in a potentially “things breaking” moment.

The two-year Treasury rate has nearly returned to its high from the Fall, right around 5% (94th percentile going back to 2000),

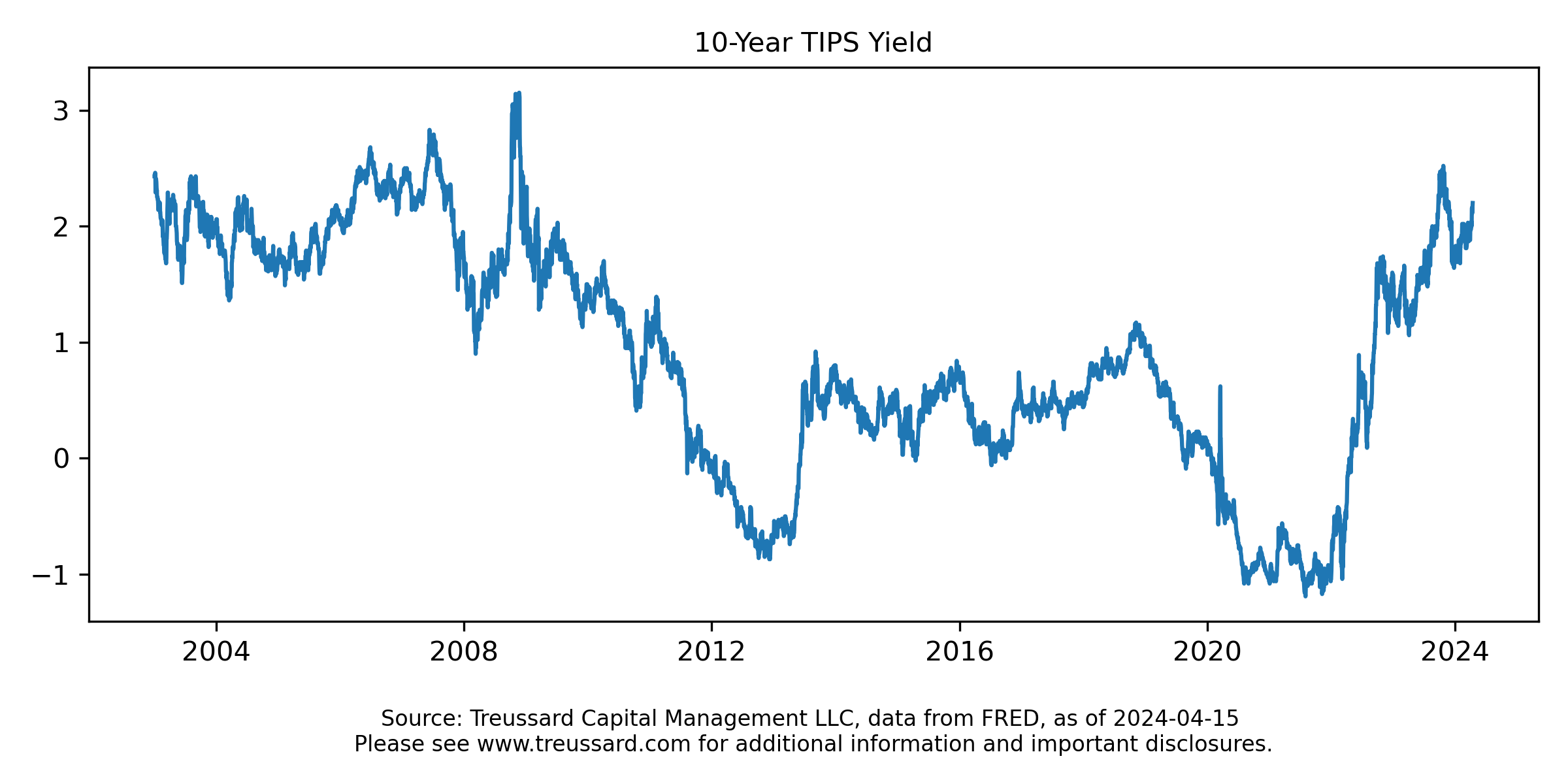

The ten-year real yield (the yield you can get on top of inflation with TIPS) is now 2.2% (91st percentile),

Oh, and the 30-year mortgage rate is back to flirting with 7% (90th percentile).

This means that banks with long-dated loans on their books have more bad news on their hands and that the US Government’s rising funding cost is adding to the IMF’s rare warning that the nation’s “fiscal stance […] is out of line with long-term fiscal sustainability.” So something could break at home. Hard to know what it could be: Maybe it’s an asset class where pain is already in the price but is finally turned up to 11, like office buildings. Maybe it’s an asset class like high-yield corporate debt where the spread to Treasuries is still very low (3.3%, or 9th percentile vs. all data going back to 2000).

And then there is the rest of the world.

Until recently, simply put, rates were high all over, at least that was the general state of things. Now, the Fed may stay here for a longer while and Europe is preparing to cut its own rates. This means that the US dollar could strengthen further from an already expensive place. In fact, people are talking about the Euro revisiting parity with the dollar if this keeps up. The mechanics are simple, people send their savings to the US to earn our higher interest rates, this causes demand for the dollar to rise, causing the value of it to go up as well. The Yen is also rising to historically cheap levels (See chart below).

But as the dollar is buoyed by high interest rates at home, it’s causing trouble for emerging countries who have local debt denominated in US dollars and are often net importers of crude oil (also denominated in US dollars on world markets and now firmly anchored around 90 bucks a barrel). We should be grateful to emerging nations for their relative fiscal conservatism during the deep Covid era, certainly relative to our own. That should give everyone additional runway so that emerging markets may avoid something resembling the late 1990s debt crises. But still, this is not good for their currencies and their economies. And confidence is not something you can bank on.

Sadly, that may be the thing that corrects our excesses. As the US has caught a fever, the rest of the world may be forced to throw the global economy into an ice bath to break the fever. Historical parallels are imperfect (especially fraught when it comes to pointing to some of the worst times in modern history) but this is reminiscent of the summer months of 2008, where crude oil was hitting new highs while the global economy was facing a generational slowdown. There are reasons to discount that scenario significantly. But in the meantime, we may be well-served to acknowledge that the future is profoundly uncertain, as US equity markets are quickly learning (with the VIX volatility gauge jumping from low teens to about 20 in a few weeks, or a move from the 34th to the 58th percentile).

In the Meantime, Kids are Applying to Colleges

Let’s close with something a lot less metaphysical and a lot more knowable. Where should kids go to college?

Bloomberg just had an incredibly valuable article on the relative value of different types of college, based on data from Georgetown University Center on Education and the Workforce (Open source).

The general answer is, if your kid gets into an Ivy (a real one) and you can make it happen financially, that seems to be a good investment (See purple dots to the right, with the high return on investment). If they don’t get in or if that’s not an option, the public flagship schools are probably the second-best options (See red dots, with UCLA not so randomly highlighted…).

The so-called “hidden Ivy” elite private colleges are a mixed bag at best with some not-so-great returns on investment. Tulane and Oberlin are basically breakeven. Art schools are tough go, such as Julliard (ROI: minus $28K return on education over 10 years), Pratt (minus $22K), New England Conservatory of Music (minus $100K), and California Institute of the Arts (minus $116).

Long way around the block to say, higher ed is hard to think rationally about, as is anything having to do with our kids. Of course, every child is different and circumstances deeply personal (which is why this is purely education, nowhere near anything like financial advice). But being informed may help avoid some real disappointments decades into the future.

Thanks for reading. I know we pack it in. So thank you! And feedback is always welcome. You can contact us here: https://www.treussard.com/contact. As always, everything in this piece is meant as education, not financial advice (including the bit about college choices...).